November review- Closing the project.

Disappointing news from my side... closing the trading project.

The last couple of months were not easy. I felt I didn’t have a big edge on the market even after so much studying. I was trying to keep going with the hope that I will get it, and that things would improve, but no… there was a strong feeling of randomness that I did not like. As a result, I decided to give up on the goal. Very disappointing and emotionally devastating for me because I invested a lot of time, money, and effort in this project. I saw this project as a way to achieve financial freedom and the next step in my life, but now I have to make a U-turn being quite broke and with a lot of dreams and plans throuwn to garbage. Below, I will share some thoughts on what triggered me to give up. In the next months, I hope I will recover emotionally and write a couple more thoughts on this journey I went through so people who will attempt to do a similar thing don’t make my mistakes.

What triggered me to stop the project (give up)?

A. There was a high number of setups but not many breaking out – by default, the environment is way more difficult than I initially perceived.

In July, after spending more than 6 months in deep dives to make sure I knew the setups, I started to trade again. What I started to perceive is that even after so much time studying things did not become easier. And by easier, I mean that I did not feel that all the time spent studying created a meaningful edge to make good quality decisions that I could use in the long run to make good trades and become consistently profitable.

On the Breakout setup – something that surprised me was the high number of setups that I had on my daily watchlist in a good market (between 7-15 setups). At the same time, I was not having any particular skill or relevant diagnosing tool to make a good quality distinction between the setups that will breakout and those that didn’t. It all felt very random and very highly dependent of the external factors and not my skills, and of course, this was followed by mistakes.

B. There are not so many diagnostic criteria that can give edge. Setups that have diagnostic edge are very very few- maybe 1-2 per month.

For eg. during the deep dives I looked at volume in the 30-minute breakout candle and in 48% of cases there was no unusual volume. So, half of the breakouts happen without seeing something particular about volume. This triggers you to get into many setups (chasing) that in the end get back in the range, stop you out and you lose money. When it comes to price, the stock can do absolutely everything, and because the tickers have high ADR, you get stopped out in a lot lot of cases… which means, again, step by step, you lose money. Being a doctor is difficult, however doctors have a lot of tools, screening devices, testing methods that help them understand the reality of the patient and contribute to a better diagnosing which improve the probability for a good decision. When it comes to trading, I thought those diagnostic gems are hidden in the technical chart, however during this period I saw that there are not that many criteria and a ticker can do absolutely everything.

C. Breakouts and EPs are highly correlated with the market.

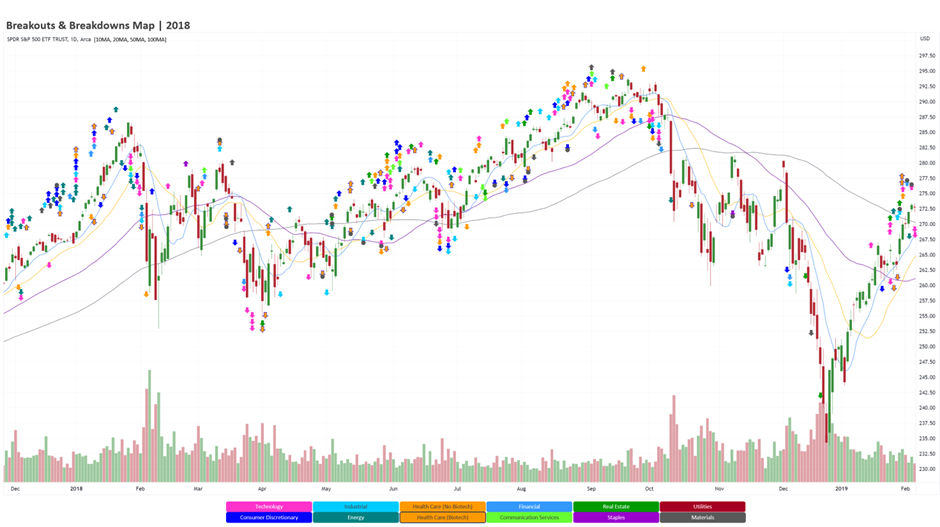

In the months when the market is going through a contraction, you cannot do much; you have no opportunities for profit, and you just sit like a vegetable in front of the screens, looking through stocks. If you already made money, then these periods don’t add pressure, but if you are a new full-time trader, then these periods are not nice. In addition, this year, we are all waiting for a recession, so thinking that you could go even 6 to 9 months through a bearish period without doing much is a scenario you definetly want to avoid. I saw this element of quietness on the map when studying historical charts (see below end of 2018 in 4 months less than 10 breakouts), but seeing it on the map and living it one day at a time is a completely different experience. Not doing much for 4 months in a row you start questioning if you are doing the right thing.

D. Trading the setup and risk management within the setup is not easy.

The setup is a proof of momentum, but this does not make it easy to catch it. The setup can continue sideways for days without doing much… the setup can attempt to breakout a couple of times before the actual breakout which means you can lose money couple of times, give up and then look how the setup breaks out…the setup can have a very nice consolidation and then just breakdown… the setup can breakout have a bad news catalyst on the market and get back in the range and stop you out… all outcomes are possible and one outcome that is more likely you possibly guessed it... it will stop you out.

When it comes to risk management things are very challenging because there are many setups. If there are 10 setups and it’s impossible to diagnose (predict) which will breakout you are inclined to risk a bit on couple of setups that you think look better. Let's assume you risk 1$/1R per trade and you add a position on 5 setups (total risk 5$/5R). It is very likely you will get stopped out from the majority of them, so you lose 5$ in a day. If you lose 5$(1R*5) per day during 20 days that’s 100$ lost with the hope to find those 10 setups ( there are not more than 10 good quality per month I assume) that will give you 5-10R (5*10R=50R). Even at 1$ risked per trade it is a meh experience, but if you risk 5-10$ per trade the losses can be very high and you get triggered emotionally.

I perceive and I see these days that the trading environment is way more difficult than it seems to be. In addition, because there are so many setups that fail or stop you out, you cannot increase position size and you just stay for days losing money step-by-step and making a couple of $ on the tickers that breakout. This is very demoralizing. Also, have in mind you also have the elements of human nature that make things even more difficult (overtrading, chasing, risking more than you should etc).

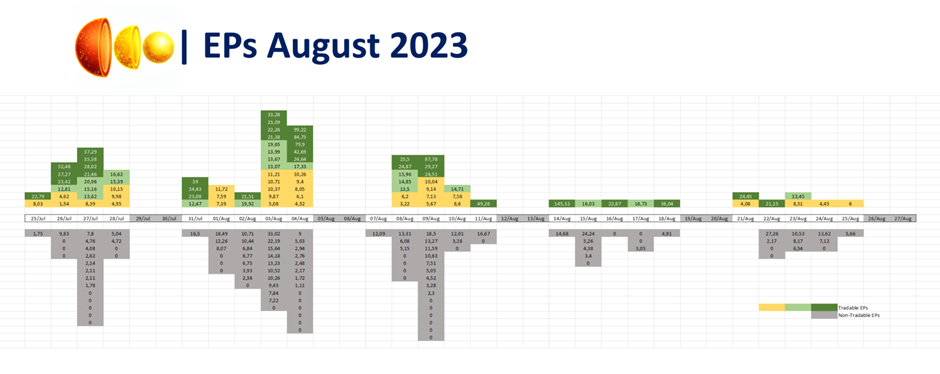

For EPs the situation is exactly the same. There are a lot of EPs happening but not so many have a strong continuation. The EP day is choppy and very often you get stopped out as a result you cannot risk big amounts of money. And with low amounts of money risked come low profits that make it not worth it to focus on the setup (another vicious circle). Here is a study on EPs done for the month of August and their outcomes. Pay attention to how many EPs happened and how many have a low-quality outcome. After couple of days all traders talk about EPs that happened and had a nice move up, sharing charts, creating the booz, but nobody will tell you there were 7-10 EPs in that same day that did not do much and those are the EPs that make trading the setup difficult and what is worst there is almost no difference between the EPs that run and those that don't. Nobody is sharing good-quality, systematized, unbiased data and edge that can help you differentiate between EPs. It is all just charts pointing that tEPs happen and a form of noise that can be very distractive for beginner traders and very missleading because it creates the perseption that "well you are not profitable because you don't trade the setup; once you will learn the setup this is when you will have the edge..." but that is not accurate.

For a very long time, I thought that once I will learn the setups (breakouts and EPs) then I will get an edge that will help me to find the profitable setups more easily and achieve consistency in trading. These days, I perceive both setups as having a lot of noise around them – daily there are many breakout setups which are impossible to diagnose while being in consolidation and many EPs that can do whatever they want. If in a month you have more than 100 tickers in the watchlist out of which maybe 10 will breakout then this thing is still difficult… and its not about hard work, its not about practical skills or innovation or not giving up… you still don’t have an advantage and you have a lot of situations when you can lose money!

To pass through this noise without having a competitive edge is very difficult. I also don’t know if in time I can create this edge on my side as Qullamaggie did. Maybe I don’t have what it takes to escape this gravity of randomness and being a successful trader is also about having some conscious and subconscious elements/skills that are very hard to grasp or develop. From time to time, we have these violin or piano genius performers that are crazy good, maybe traders that succeed in this particular style are in this category, and I am not that kind of person and maybe I will never be (It's kind of a bad idea to try copy Mozart... he is just one of a kind). As a result, from this point onwards, things don’t depend on hard work or practical skills, and I don’t want to risk another year of work as I am not sure I will be able to develop the skills that I need. So I decided to stop my journey…

When looking back at these years of studying, I realize that the most difficult thing about trading is that setups do happen. This manifestation is real. The hard part is that there are many many manifestations that look like good setups but those are fake… nobody talks about them too much because there is a lack of systematic studying and analysis…did you hear about someone who counted all stocks that show a first leg with consolidation and then all outcomes (up, sideways, down)? Nope, me neither. I studied those that go up and those that go down, but looking back I realize that this was a researcher bias that has an important statistical implication on the outcome. Later, this is where I felt that I got stuck…into a large number of stocks that look like setups but in the end they don’t do much besides slowly depleting my account.

These days I think the journey is so risky, with such a statistically low chance to make it that it is not worth it. It is not about hard work, it is not about commitment. Throwing a basketball ball and making it consistently from 50m is not about hard work or decent level of inteligence...

Thank you to everyone who read my journal and supported me during this one year and a half of the journey. I started to look for a job and making the effort to recover emotionally and be optimistic about the future. I will write 1-2 more articles in the next months to share a couple of extra thoughts. Until then, best of luck and take care! Thank you!

Update March 2024.

After I gave up on the project in November, I started to search for a job. From the moment I started searching till the moment I found a job, it took me 3 months. Those 3 months were quite challenging I would say, but I was lucky that I found a job as a Product manager in Healthcare again, and I am back in The Netherlands.

Trying to put my life back together one step at a time. From the moment I through I would like to be a trader (and started saving money) till the moment I closed the project was a total of 7 years.

If there is something I was very surprised to find out is how biased is the world around us. Everyone talking about couple of people that succeded and nobody talking about the thousands and thousands that failed.

There is a cliche that your brain hears "trading is difficult" but does not believe. Some people say 90% fail and 10% win in trading; I think that amount is more like 1 in 7000 succed. Probability of making a living from it is so small that I suggest you dont try it. Do something else you thought you wanted to do: open a food restaurant, buy some land and do a farm, open a car service... you choose it. To me those are difficult but could give you results, just dont do trading. Sorry, I may sound pesimistic but what will your advice be if you will know the success rate is 1 in 7000? (will not publish how I calculated it but thats the number I got). If you found my journey or content helpful to make a personal decision please buy something from the store. It will help me recover. Once I get most of my money back I will give the content for free.

Thank you to everyone that supported me across the journey.The debates, the analysis, your questions and support made the journey super cool. Good luck!

Comments ()