August Review-September Goals

August Review: Trying to apply in practice what I learned during the deep dives, improving my skills, and trading small positions. For a big part of the month, the market was bearish; I had to stay defensive, and I got stopped out a lot. However, I am happy that the practice is going well, and I continue learning new details. The process is in continuous improvement so far, and every week, some extra small adjustments are made to better react to market developments. Nothing ultra-complex, just doing the right things at the right time of the day. I am not making much money yet and trading small positions until I see a more consistent performance from myself across the entire trading process. I expect to start adding position size step-by-step within 2-3 months. A confident breakeven for August (+$350).

In the last months, being focused on the processes and reading more about the companies I trade, I started to see that I am moving within a new model/framework that I could not visualize. Here are some thoughts on how I connected the dots on the bigger picture and how I perceive these days the reality of what I am doing.

There are 3 significant components as displayed in the picture below. There is a market context. Within the market context, the company (due to internal and external factors) creates an Added Value, and there are Active setups. The price can move in a random way (just random talking), but from time to time, there is a clear debate between buyers and sellers. This debate creates the setup, and this is what professional traders look for and participate in. Because I trade Breakouts and EPs for now, I participate only in those debates.

Also, there are situations when the market context blends with the added value of the company and creates a story. Stories are important because they can spread beliefs and be a source of significant momentum.

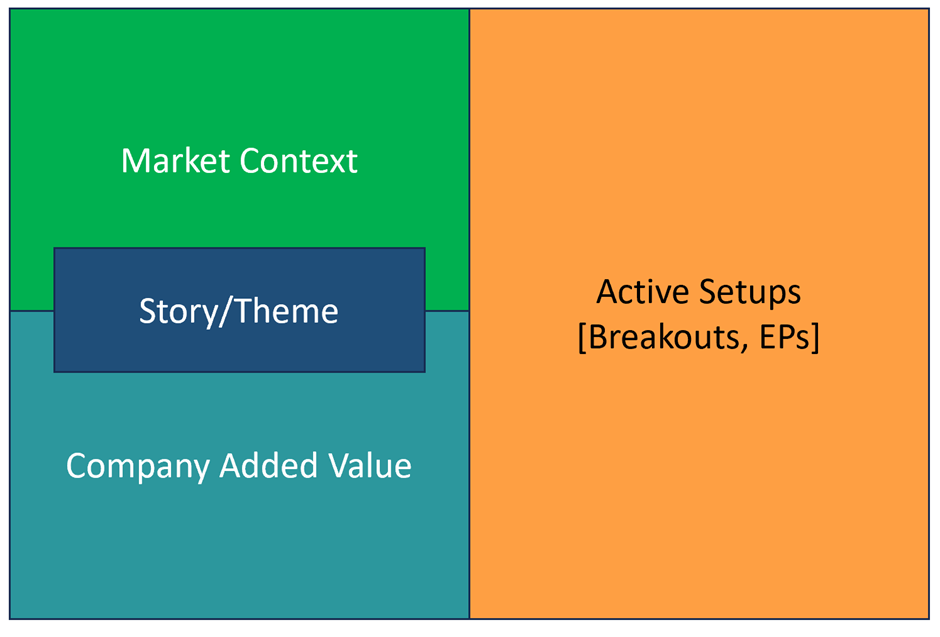

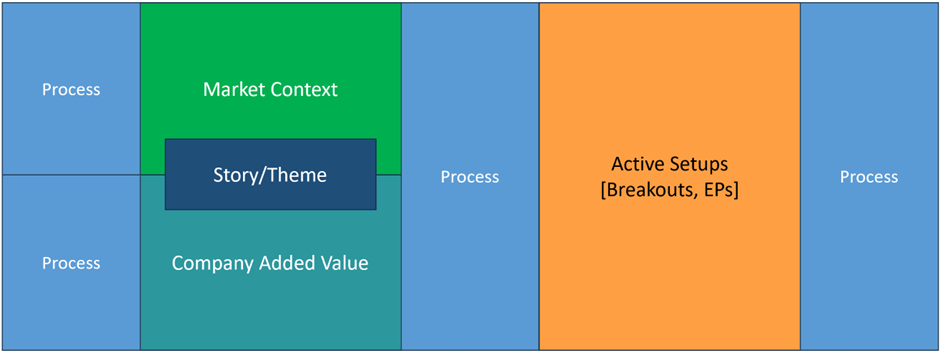

I see that I act in a specific way in each of these areas. Looking closely at what I do, I can see these areas require different skills, infrastructure, methods, processes, etc. So, the model looks more like the picture below.

A professional trader has processes to understand the reality of the market context, the company added value, knows how to recognize the active setups (the debate), and has a process to trade and profit.

This type of representation became very useful for me because it gives structure. Each process and action is now attributed to an area. I can now quickly evaluate where I am strong and where I am weak what area could be responsible for the success or failure of a trade. It can also improve my planning and how I define my next steps. I think when you become strong in all these areas, trading becomes jazz.

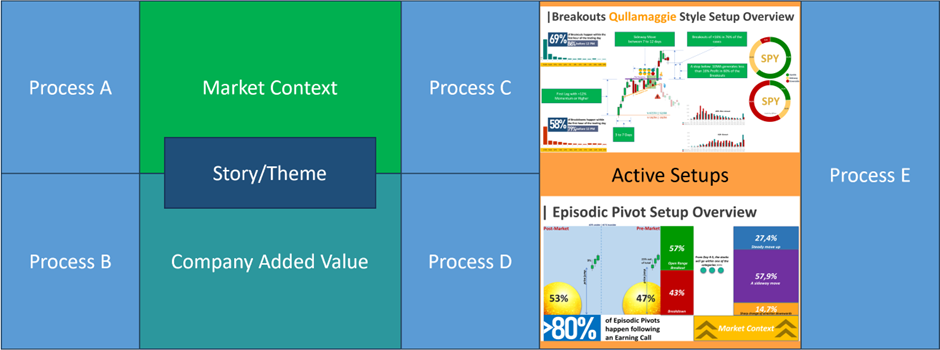

And because I trade breakouts and EPs, my personal model is more like this:

Stepping back, I see that in the last year, I was very focused on deep dives and understanding the active setups. However, I didn’t pay that much attention to building good-quality, well-coordinated processes that give results. I don’t know much about the companies I trade, and I cannot say I am very good at the market context. Some improvements are still needed.

In the last 2 months, I have been focused on processes because the setups are clearer, and I know what I need. Processes are what a trader should do over and over each day, and because of that, the tendency is to make them as easy, simple, and efficient as possible. If I can arrange things so that I can see the best EP of the day with zero clicks of the mouse, I am happy with that, and that is what I will call my EP process.

I highly advise you to take this model and evaluate yourself in terms of knowledge, processes, infrastructure, problems, challenges, opportunities, strengths, weaknesses, steps for improvement, etc., and define your next steps.

Here are mine for next month (September goals) :

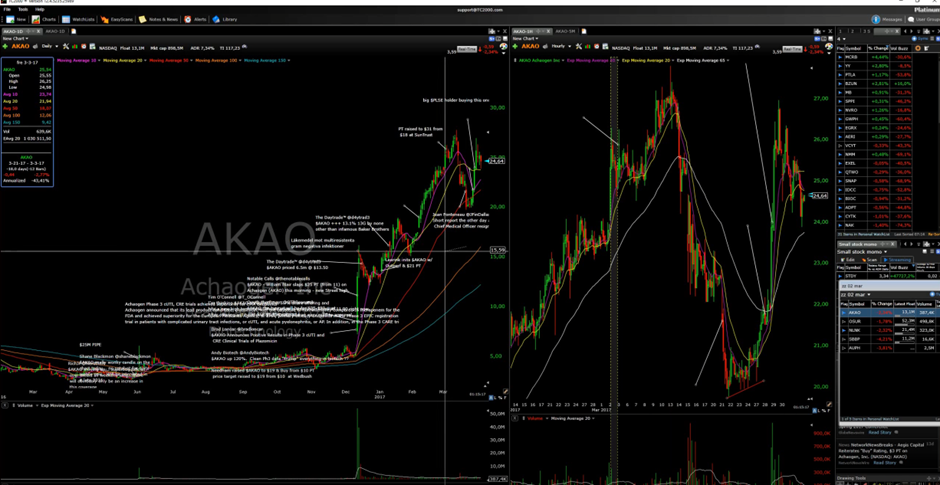

- Understand the Added Value of the companies that display Active Setups. This is the area where I would like to progress the most in the next 3-6 months. The main goal is to understand better the companies I trade, their competitors, their strong and weak points, financials, and analysts' analysis (Process B). Looking at Kristjan's videos, I can see he is reading a lot about the companies he is trading. The goal will be to do the same and add valuable data in TC2000. An example below:

- New calculation on Breakout Attempts may happen in September. Previous analysis was removed from YouTube for now as the measurements were challenged. The main critique is that in some situations I considered a stop-loss that is not what Kristjan will advise.

- Review Breakouts that happened in August.

- Progress on TC2000 and TradeIdeas process for breakouts and EPs.

- Watch @Qullamaggie historical videos.

Self-Leadership and Mental State

All this project is like managing a startup. You burn money and stay optimistic, hoping that one day you will make it. Yeeeey! 😊 Vamos!

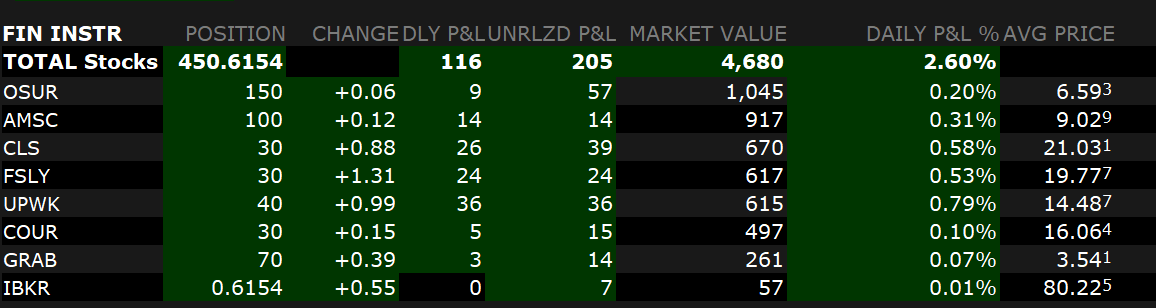

To end the review on a good note, adding a printscreen with a day when all positions were profitable this month.

I wish you a good month ahead,

| @flow

Comments ()