January Performance Review

There are already six months for me as a full-time trader. While studying in January, I realized in the last six months, happened a significant change in how I spend my time, which now I consider a correct way, and I wanted to share two main ideas:

(1) Charts, Charts, Charts!

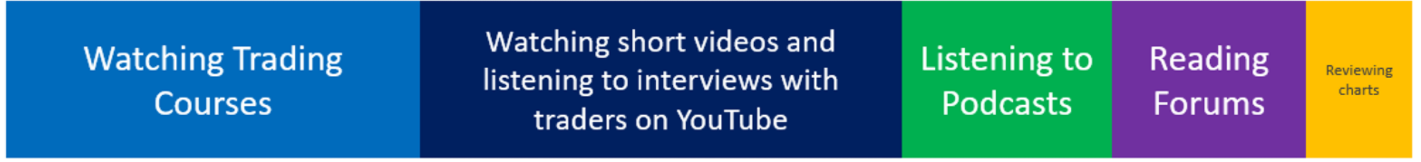

Since I started to study trading three years ago, I have been spending almost all the time allocated for trading, watching paid courses, watching short videos and listening to interviews with traders on YouTube, listening to Podcasts, reading a lot of books, and of course, reviewing some charts. If I think about how the time was distributed between these activities, it should look something like this:

Since I am a full-time trader, I decided to study in a more systematic and structured way to increase my chances of making it. I started doing more deep dives on historical data, which triggered a significant shift in how I spent my time. Here is how it looks now:

I was thinking recently about how different the experience is. If I ask myself what will be the best approach from the position I am in now, reading historical price action is the activity where my brain learns the most. If you are beginning to study trading, here is a suggestion:

- Learn the basics of how to read the Charts (what candles and moving averages are etc.)

- Choose a setup - I suggest you start with the Breakouts setup

- Read as many historical charts as you can in a structured and organized way. Grouping stocks correctly, doing deep dives and making print screens, collecting print screens, and reviewing them side by side. See my deep-dive videos to understand what I mean. Ideally, if you can find a trader that already did that, it's top in class, and it will speed up your learning curve like crazy.

If you spend time with books, forums, or watching interviews with traders, that's the biggest waste of time ever. There are 2-3 good interviews to watch, but the charts are where the magic is.

(2) A good trading desk is an edge.

I am spending these days between 10 to 12 hours per day at my desk studying. I realized I made an excellent investment in buying a standing desk, good quality screens (1 - 32’ and 2-27’ is my setup as of now), good quality Herman Miller chair...etc. Minor improvements to your desk will pay off as it will keep you productive and in good working mood. Here is how my desk looks now:

I highly recommend you to think seriously about your desk if it doesn't look close or better than what I have. You will thank me later. There are a lot of videos on YouTube with desk setup recommendations.

An interesting finding on Episodic Pivot in January, here is how it went:

- Create an Episodic Pivot Map/ Done. You can watch the video here: https://youtu.be/NFDSgzL2KFM

- Start the study: " Episodic Pivot Catalyst analysis" / Done

- Start the study: "Side by side EP and SPY (or IWM) comparison" to better understand the relation between EPs and the overall market. / Done

February goals are on the way!

Comments ()