September Review-October Goals

In September, the main goal was to start learning more about the companies I trade, and it was a very good decision. For the breakout setup, I have most of the time between 7 to 20 stocks on the watchlist, and for the EP setup, now that the earning season peak is behind, I have between 3 to 7 per day. That means a lot of companies to read/study, which results in a large amount of data to go through.

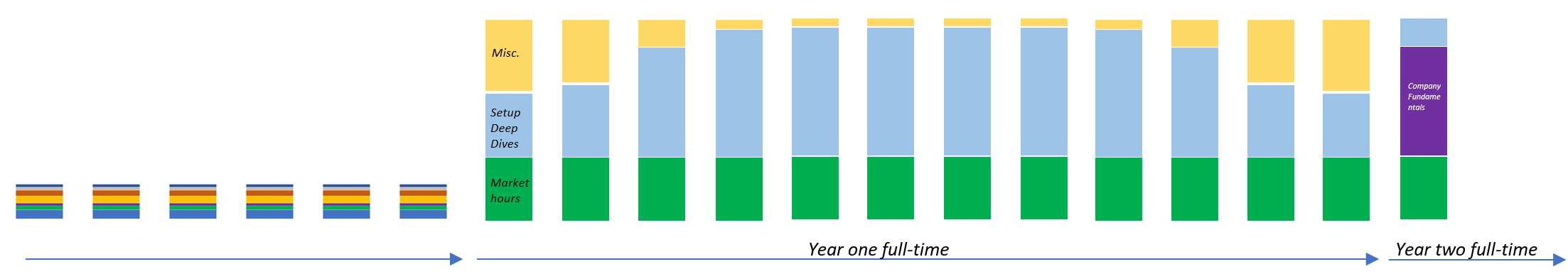

This new objective led to a visible change in how I allocate my time. If I make a chart of the last years, it should look something like this:

In the beginning, I studied trading in my free time (way less time available than nowadays), and I was doing a bit of everything (reading forums, studying software, listening to podcasts, taking courses, watching random YouTube videos, etc.) In the first year I narrowed the focus and did the deep-dives on the setups. Step-by-step technical analysis took almost all my free time and energy. Now, I am more familiar with how the stocks move within the setup, and as a result, the effort in that direction started to fade. After setting this new goal –“Know the companies you trade.”, almost right away, all my free time went into this activity, and by far, its still not enough. It takes between 1 to 3 hours to get a good idea about one company, so the speed of learning is around 2-3 companies per day, and I have on my watchlist at least 7 I don’t know, so I need 2 days to prepare… It also means it will take me some time to reach a level where I will know most of the companies I trade: around 4-5 months to know well around 250 stocks. So all the available time during the autumn and winter ahead is already scheduled.

However, this exercise is worth it. It adds new dimensions to trading, which are very useful. One of the most relevant is that you become able to evaluate the quality of momentum that is creating the price action. When studying a couple of companies, it is hard to grasp the difference in momentum; however, after a while, based on a multitude of factors and elements, you start to develop an abstract perception of how much “fuel is in the tank”. As of now, I study the following: the company website, the last 2 earning call transcripts, the last company presentation slides, company financials, news published in the last months, and the last 5 company analyses made by value investors/analysts which are available on seekingalpha.com. This is super useful and highly recommended.

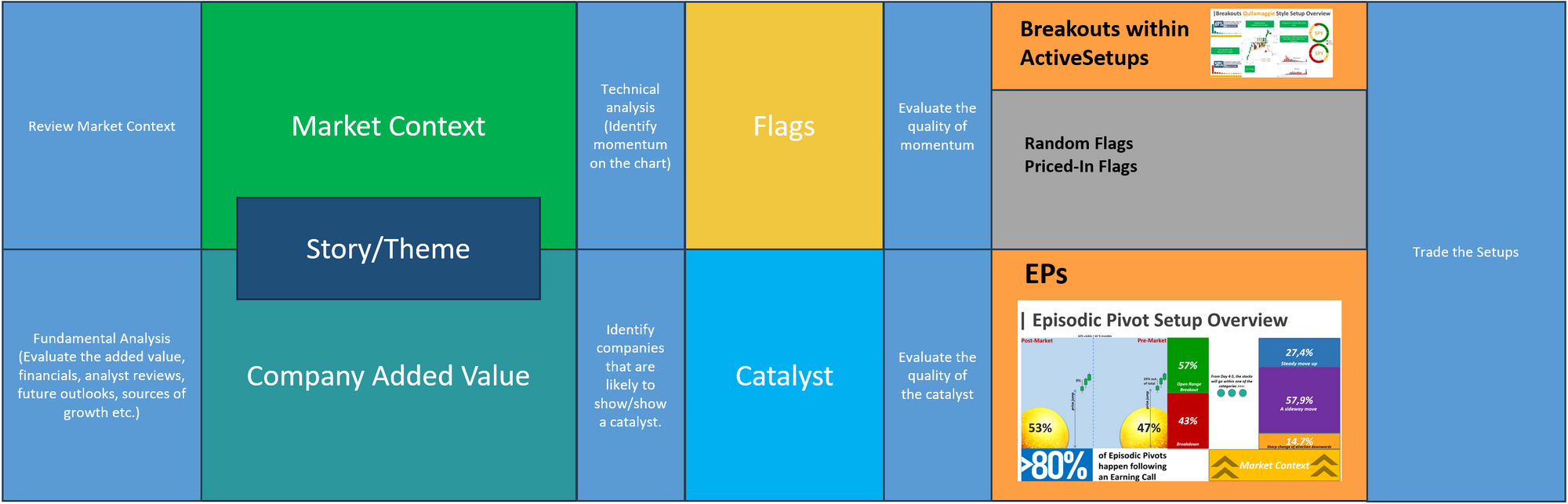

Studying the companies that showed a setup created another learning point related to Breakouts: Not all Qullamaggie Style Setups have a good quality momentum and are good quality Breakout Setups. A very large majority of setups are just flags. There is a very narrow difference between an active setup that has the energy to breakout and a flag that looks like a setup. The setup is a way to find and evaluate momentum but has no guarantee that momentum will continue with a follow-through.

In some situations, with the new move in the first leg (which is usually higher than 14-16%), the market is already pricing in the new fundamentals or catalyst, and the energy of the stock is depleted and in some situations, the price action is quite random, and by chance, it looks like a flag.

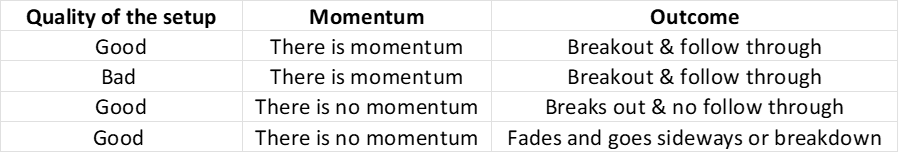

The market shows a couple of combinations:

There are also situations when the quality of the setup is not that good, but within the stock there is momentum, so the quality of momentum takes priority over the quality of the setup. That is why additional actions are needed to evaluate the story, the catalysts, and the fundamentals of the stock to make sure there is “fuel in the tank”.

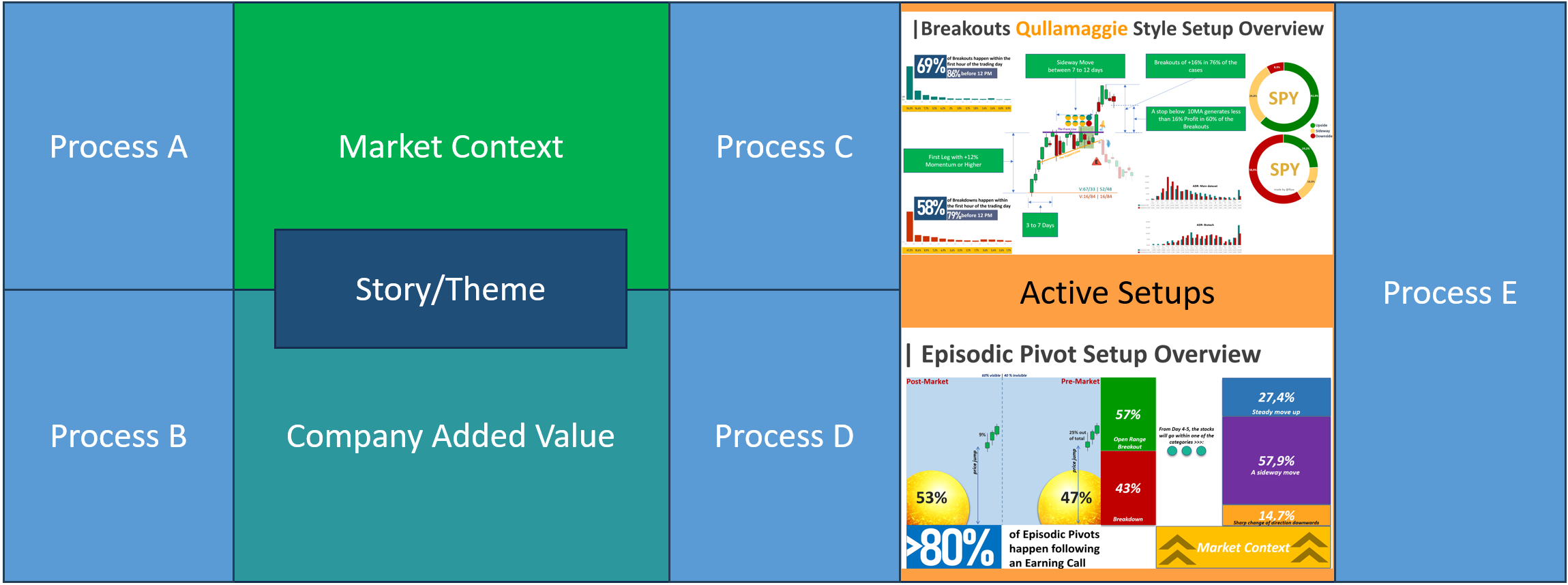

Here is the framework shared last month. I use it to see how different processes and areas of trading combine together:

Adding a couple of updates after trading the setups in September, and giving a name to processes to add clarity:

Some key points: there is a difference between flags and active setups (1); it is not just finding and trading the setup (especially for breakouts) (2). There needs to be a lot of focused effort to learn how to evaluate the quality of momentum and the quality of the catalyst. With time, I assume the skill becomes subconscious and takes less effort as you just learn the updates, but at the beginning, it involves a lot of reading.

October Goals

· Read 5 hours a day the stocks from the watchlist and with earnings ahead in order to learn the companies I trade an develop the skill to evaluate momentum.

· Make the September Analysis for Breakouts and EPs

Self-Leadership and Mental State

All goes nominal. Still, a good amount of work to be done.

Wish you a good month ahead,

@flow

Comments ()