The Structural Form of The Market

... and what to do about it as a trader

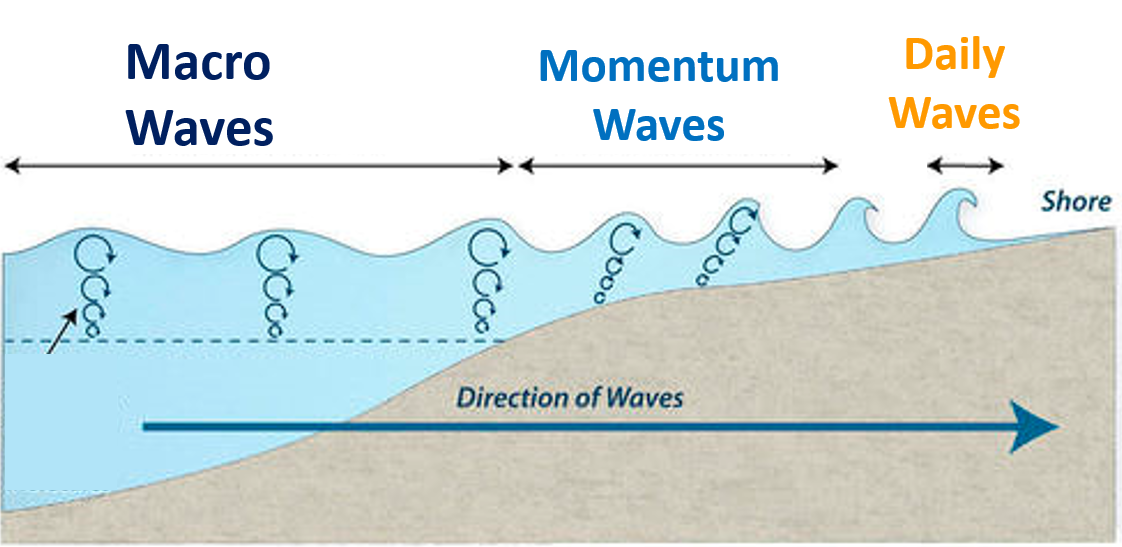

The more I study trading, the more my brain associates the market with an ocean wave approaching the shore. The more I understand trading reality, the more I realize that the wave presents itself in 3 different forms, which is why I consider them three different waves and will describe each of them separately. I assume economics studied and gave what I describe as theoretical terminology, but I don’t know it yet. For now, in the context of retail trading, I gave them the following names: The Macro Wave, The Momentum Wave, and The Daily Wave. More of them flow simultaneously, coming with a different force from different directions, interacting with each other, and creating the market reality.

This video on YouTube on how waves are created is cool. To me, something similar happens in the markets: https://www.youtube.com/watch?v=VjJcJ8Ul-hc To bring a point, I will use the drawing below, which I adapted a bit from a drawing that explains how the wind creates waves.

The Macro Waves

These waves are created deep in the ocean by massive forces. They have significant power, but for us sitting on the shore, they seem unperceivable, far away, and invisible to the naked eye. Some macro waves are human productivity, creativity, supply and demand, innovation, climate change, education, civilization, trade, globalization, etc. Experts that study those to protect us in the future are macroeconomists (they take positions in the central banks), and experts who try to harvest their energy are macro investors (the mutual funds). Very closely watching and being that big that could even influence the direction of macro waves is The US Fed because it regulates one of the biggest world economies.

There are parameters based on which macroeconomists measure these waves and how the ocean is doing. The most common ones are Employment level, Consumer price index (CPI), Purchasing managers Index (PMI), Job openings, Inflation rate, Interest rate, Debt, etc.

What do I do about this wave? I constantly read news, and macroeconomic reports, listen to YouTube podcasts and follow macroeconomists to create my perspective on how the macro market is and what Momentum waves could result from it.

The Momentum Waves

The energy from Macro waves creates Momentum waves. The momentum wave is what we call the story sector, momentum sector, or sector in play. The power of Macro Waves creates sector rotations and different stages of the economic cycle. This is a wave that can be of different lengths, and a retail trader can see, analyze, compare, and watch closely at the sector level but also at the stock level (stocks in play, momentum stocks). These waves are visible from the shore but still further away and longer. The swing traders try to harvest the energy of momentum waves!

I assume that while studying the market, EG found the energy of the momentum waves, and here is how he came up with all the methodologies around Momentum. To benefit from momentum, you can harvest smaller waves of 3 to 5 days (to me, EG has a high focus on these, but he is also surfing long waves too) or longer waves (if we take based on profits, KQ is the Pro of the Long Momentum waves :D ).

What do I do about this wave? I know that from this wave, I can profit. In the last few years and even now, I have been trying to learn swing trading methodologies, build the skills, infrastructure, self-leadership, and situational awareness, and understand this reality to become a profitable trader. By far, most of the time, I spend studying EG’s methodology on how to profit from it. I hope one day I can make it, and I hope you do too!

The Daily Wave

The Momentum waves approaching the shore create Daily Waves. Day traders harvest the energy of these waves, and to me, Day Trading is like Surfing. If I analyze closely, what day traders do is they look for a stock with momentum, check key structural market levels, and then at the right moment, based on their technique, enter the trade and follow it in a specific way. This is very similar to what surfers do… they search for a wave with momentum, then swim on the board to a particular location of the wave (structural position of the wave) and then when they feel the moment is right, they jump on the board and surf the wave using specific techniques.

From what I read, mmonis is the trader that trades the daily waves the most. He has a well-defined methodology that he shared consistently on the Stockbee site. I assume more traders do the same, but I haven’t read their techniques yet.

Mmonis methodology is based on Key structural levels of the market. He finds these structural levels on the daily/weekly chart and considers them structural levels of support or resistance when trading intraday. He is using those structural levels for surfing the stock.

What do I do about this wave? I am very interested in the Daily wave and mmonis methodology as this technique has an edge in this particular market (Q4, 2022) and gives an edge even to swing traders. A right entry intraday can give you a 2-5% entry edge equivalent to most swing traders' stop. So if I enter like a Pro day trader, I can gain 2-3% due to entry and then another 2.5% due to the stop loss if I want to make it a swing trade, so this is a 5% stop loss distance which I don't mind at all… By studying mmonis method, I can focus on day trading for a while until more swing trades are set up.

Understanding Macroeconomics and the Macro waves can be an Edge! especially nowadays when so many macro events are happening (war, high money liquidity, inflation, Fed interventions).

Understanding each of the waves can improve Situational Awareness!

Swing Trading and Day Trading look similar, but some techniques are different!

Swing trading methods can give Day trading Edge!

Day trading methods/entry can give Swing trading an edge!

You can still be profitable just by understanding the nature of one of the waves!

Understanding the three waves can make you a Pro Navy Seal Trader!

Do you think this perspective makes sense?

Disclaimer: as I get more experienced, my views will change, and I will consider what I wrote wrong, so please take this with a grain of salt.

First version: November 5th, 2022

Comments ()